Optical transceivers, optical DSPs (oDSPs), and switch ASICs are the core components of data center optical interconnects. The emergence of LPO (Linear-drive Pluggable Optics) and CPO (Co-packaged Optics) is driving the industry toward lower power consumption and higher density.

I. Core Component Functionality Analysis

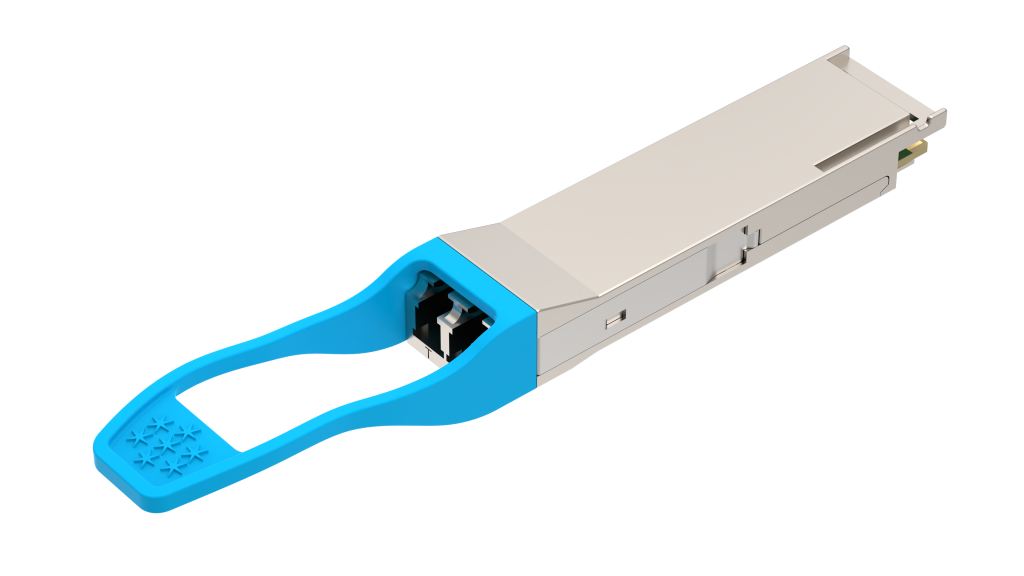

1. Optical Transceivers: The Bridge for Electro-Optical Conversion

Optical transceivers are critical devices that convert electrical signals to optical signals and vice versa, widely used in data centers and telecom networks. Key functions include:

- Electro-Optical Conversion: Laser diodes modulate electrical signals into optical signals at the transmitter; photodetectors convert optical signals back to electrical signals at the receiver.

- Rate Adaptation: Support multi-rate standards (e.g., QSFP-DD, OSFP) from 100G to 1.6T, covering transmission distances from 50m to 2km.

- Signal Processing: Traditional transceivers rely on DSP chips for equalization, error correction, and dispersion compensation (e.g., DSPs account for ~50% of power consumption in 400G transceivers).

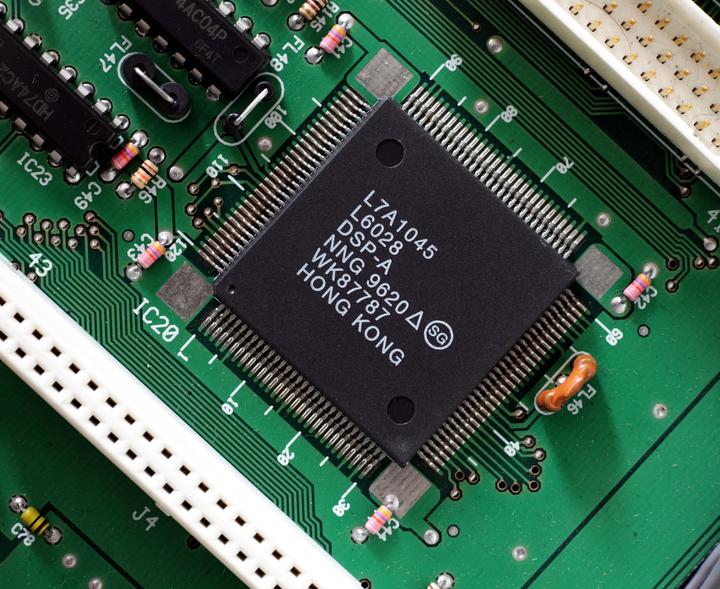

2. Optical DSP (oDSP): The “Brain” of Optical Transceivers

oDSPs are the most valuable electrical chips in transceivers (20%-30% of BOM cost). Key roles include:

- Modulation & Demodulation: In data center scenarios, PAM4 oDSPs use 4-level modulation to boost single-channel rates (e.g., 50G/100G) and compensate for signal distortion. In telecom long-haul scenarios, Coherent oDSPs use QPSK for high-sensitivity transmission.

- Signal Regeneration: Digital signal processing (e.g., FEC) restores degraded signals to ensure long-distance reliability.

- Power Consumption Challenge: In 800G transceivers, oDSPs consume ~6-8W, becoming the primary power source.

3. Switch ASICs: The Central Hub for Data Forwarding

Switch ASICs are the core of switches, responsible for high-speed data frame routing and forwarding. Functions include:

- Port Interconnection: Support multi-port high-speed connections (e.g., 112G SerDes) for low-latency data exchange between servers and storage.

- Protocol Processing: Integrate PAM4 modulation, CDR (Clock and Data Recovery), and flow control to ensure signal integrity.

- Collaborative Optimization: In LPO solutions, ASICs assume partial signal compensation (e.g., linear equalization, clock recovery) previously handled by oDSPs.

II. Technological Breakthroughs and Impacts of LPO & CPO

1. LPO: Cost and Efficiency Gains in Pluggable Architectures

Technical Features:

- DSP-Free Design: Replaces DSPs with high-linearity Driver/TIA chips, eliminating CDR and complex digital processing to reduce power, cost, and latency in 800G LPO modules.

- Compatibility: Retains pluggable formats (QSFP-DD/OSFP) with hot-swappable maintenance, suitable for short-reach (<2km) AI clusters and cost-sensitive scenarios.

- Standardization Progress: Based on OIF CEI-112G-Linear-PAM4, supports partial 800G commercialization, though 224G SerDes requires further validation.

Industry Impact:

- Power Revolution: A rack with 100 400G LPO modules saves >¥2,000 annually in electricity costs (PUE 1.5), with reduced cooling expenses.

- Supply Chain Shift: Reduces reliance on DSP vendors like Marvell/Broadcom, driving localization of Driver/TIA chips.

- Scenario Limitations: Relies on switch ASICs for signal compensation, limiting competitiveness in heterogeneous networks.

2. CPO: Performance Leap in Co-Packaged Architectures

Technical Path:

- Near-Packaging Evolution: From NPO (co-board optical engine) to CPO (co-packaged optical engine), reducing signal transmission distance from 10cm to millimeters, cutting power by 30%-50%.

- Integration Morphologies: Includes Type A (2.5D), Type B (Chiplet), and Type C (3D) packaging, advancing deep integration of silicon photonics with switch ASICs.

- Silicon Photonics Core: CPO relies on silicon photonics for high-density optical device integration, with silicon photonics expected to capture 60% market share by 2030.

Industry Impact:

- Performance Boost: A 1.6T CPO system supports 51.2T total bandwidth with sub-nanosecond latency, meeting AI training clusters’ ultra-high bandwidth demands.

- Ecosystem Challenges: Initially reliant on proprietary designs (e.g., NVIDIA Quantum-X), lacking unified standards, and high O&M costs due to whole-unit replacement for optical engine failures.

- Market Differentiation: CPO targets scale-up networks (e.g., multi-rack AI clusters), while scale-out networks still rely on pluggable modules.

III. Future Trends and Technological Dynamics

1. Multi-Technology Coexistence:

- LPO Dominates Mid-Term: By 2025-2027, LPO will rapidly penetrate AI clusters and mid-sized data centers, with >8M 1.6T LPO ports expected by 2027.

- CPO’s Long-Term Potential: Post-2030, CPO will gradually commercialize in hyperscale data centers, especially for 100T+ scenarios, as silicon photonics matures.

- DSP Persistence: DSP solutions will remain mainstream for long-haul and heterogeneous networks, with power-optimized “Link Optimized-DSP” variants.

2. Synergistic Innovation:

- Silicon Photonics Fusion: Enables LPO (reduces Driver/TIA costs) and CPO (achieves high-density integration), serving as a foundational technology for both.

- Packaging Breakthroughs: 3D packaging and TSV (Through-Silicon Vias) advance CPO to Type C, shrinking size and improving thermal efficiency.

- Standardization: IEEE 802.3 and OIF efforts will accelerate LPO interoperability, while CPO requires open ecosystems to resolve compatibility issues.

3. Supply Chain Restructuring:

- Chip Vendors: Marvell/Broadcom maintain DSP dominance but face LPO competition; NVIDIA/Intel integrate silicon photonics with ASICs via CPO to strengthen system-level competitiveness.

- Transceiver Vendors: Innolight, Eoptolink, etc., actively deploy LPO/CPO but must balance investments with market demand to avoid over-commitment.

- Foundries: TSMC, STMicroelectronics, etc., expand silicon photonics capacity to enable CPO mass production.

IV. Conclusion

The emergence of LPO and CPO marks a pivotal shift from “pluggable-dominated” to “integrated-evolving” optical interconnects. LPO’s low power and ease of deployment make it a mid-term mainstream choice, while CPO’s extreme performance represents the long-term direction. Their competition will drive data center architectures toward greater efficiency and intelligence, offering opportunities and challenges for silicon photonics, advanced packaging, and other underlying technologies. In the future, synergistic development across multiple technological paths will become the norm, with standardization and ecosystem collaboration determining the pace of technology adoption.